RMBS Primer

9/30/2024

Overview

Residential Mortgage-Backed Securities (“RMBS”) are an integral part of the multi-trillion-dollar US housing market. They offer investors a tradeable instrument to access the intricacies of the market and they offer originators a means to free up balance sheet to continue to efficiently lend to homeowners. In our opinion, some key benefits to note, among others, include:

-

Ability to create fixed rate and floating rate exposure

-

Diversification among borrowers

-

Structural credit tiering which can help fill various risk tolerances

-

Self-derisking structure via amortizing collateral rather than bullet maturities

As of 2023, the mortgage-backed securities market represented over $12 trillion of outstanding fixed income instruments. Direct participants include Hedge Funds, Insurance Companies, Banks, Money Managers and Private Equity firms. Because these instruments carry various combinations of duration, risk and return to investors, they offer participants multiple ways to invest and take views on the sector to meet their unique investment mandates.

Origin Story

Mortgage-backed securities were first introduced in the 1980s, when pools of loans originated by Ginnie Mae were securitized into the first Collateralized Mortgage Obligations (CMOs). Prior to CMOs, loan pools were created with homogenous loans having generally similar characteristics and tenor. However, different investors in the ecosystem had varying degrees appetite for duration and returns. A manager of a money market fund, for example, may require full payback of principal within 1 year, while a longer duration manager of an insurance portfolio may prefer to own investments for 10+ years due to a different liability structure. CMOs were created to tranche out an otherwise standardized pool of loans into several buckets. Investors could pick and choose which tranche best suited their requirements for duration and return of capital. This new innovative concept set precedent for what is now one of the biggest fixed income sectors in the US.

Deal Types

Agency (government backed, no credit risk):

Agency mortgages conform to specific agency standards (FICO, Debt to Income, Loan Size etc.). Losses to the mortgage pools from defaulted borrowers are guaranteed by government agencies (Fannie Mae, Ginnie Mae, Freddie Mac etc.)

Deal Structure:

At a basic level, Agency CMOs are structured to pay bondholders interest concurrently and principal sequentially. In the example below, the First Pay bond would receive the first $50mm of principal repayment from borrowers in the Loan Pool followed by the Second Pay then the Last Cashflow. Since the collateral is government guaranteed, timing of cashflows is the primary focus of most of these investors. Short duration buyers would likely gravitate toward the First Pay bond while an investor with a long duration mandate would be better served owning the Last Cashflow bond.

Non-Agency:

Agency CMOs require well defined, conforming loan guidelines to be packaged and guaranteed. This leaves an entire cohort of non-conforming loans that cannot be sold to the agencies post origination, which are appropriately named “Non-Agency”. Borrowers who do not fit the traditional agency guidelines can access loans through bank and non-bank lenders that ultimately securitize them into CMOs for balance sheet relief.

In the years leading up to 2008, the historic housing boom and insatiable demand for mortgage paper by investors eventually led to elevated levels of lax lending and borrowing. This phenomenon in conjunction with high levels of leverage in the capital markets eventually led to a crisis. The systematic deleveraging that followed eventually played itself out over the next couple of years, washing out many of the actors that played a role in one of the biggest financial crises in history. The Great Financial Crisis (GFC) caused material damage to some investors but also brought about a significant opportunity to those who were able to weather the volatility and capitalize in its aftermath. The years following the GFC presented some of the most profitable years for structured credit investors who were able to deploy capital, manage risk and take advantage of the distress that was created from the crisis.

Deal Structure:

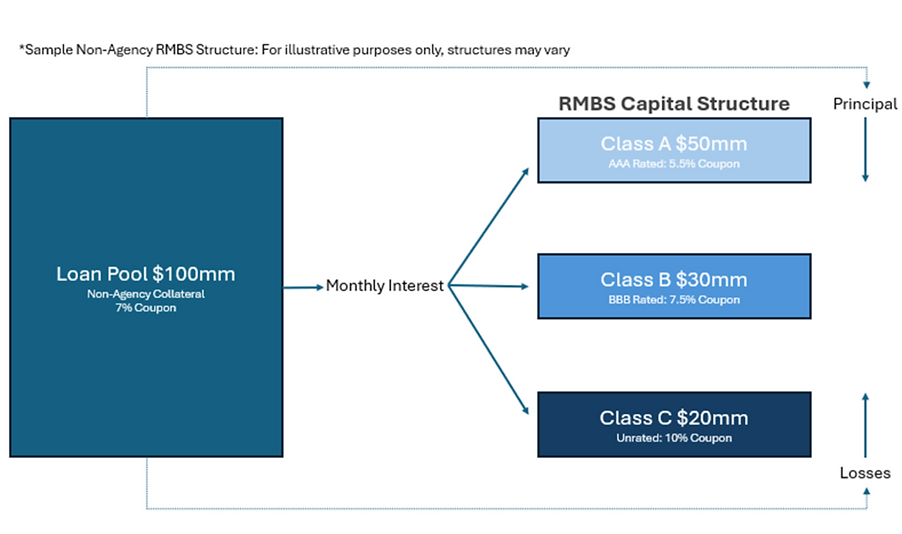

Non-Agency deals allow investors to invest capital based on both duration and credit risk appetite. Return of capital in the form of principal flows top down. Since these loans are not government guaranteed, borrower losses in the pool are borne by investors and are allocated to the lowest ranking bonds in the capital structure first - bottom up.

To illustrate this in the diagram below, the Class A bond would be first in line for any principal repayment and would need to pay off in full ($50mm) before the Class B, and subsequently the Class C bonds, could be repaid. If any losses were to occur in the loan pool, the Class C bond would bear the first $20mm of those losses followed by Class B and finally Class A. The coupon and resulting yield these bonds receive, in theory, compensate investors for the level of risk they are taking – earning higher yields along with taking more risk down the capital structure.

Question: Why would an investor choose a particular class over another?

Answer: Ultimately, the risk and return tolerances of managers in the ecosystem varies. A bank treasurer may have little to no threshold for bonds that can take losses and may opt to purchase Class A bonds and accept a lower (5.5%) coupon in return. A mutual fund investor may have slightly more appetite for risk and opt to invest in Class B. On the furthest end of this spectrum, a hedge fund or distressed credit fund with materially higher return targets and risk appetite may underwrite the loan pool and ultimately decide that it is best compensated by owning the Class C bonds which offers a 10% coupon.

Collateral Types:

As the Non-Agency market evolved, originators created various lending solutions to cater to different types of borrowers. Below are some common collateral types that are readily traded in the market along with some defining characteristics.

Legacy: This is a blanketed term for deals issued before the 2008 Financial Crisis. While they were the source of many of the headlines that dominated the crisis, these deals are now 15+ years seasoned and include borrowers who have weathered multiple credit cycles since the GFC. Some common subgroups within the Legacy space include Prime (generally the highest rated borrowers with FICO scores that exceed 720), Alt-A/B (FICO scores generally between 600 and 720, limited documentation, sometimes atypical sources of income) and Subprime (less than 660 FICO, checkered credit history, little to no documentation, and higher debt to income ratios).

Prime Jumbo: Top tier FICO scores, explicit employment and income documentation. Loan sizes exceed agency conforming limits and are often made to highly credit worthy, affluent borrowers.

Non-QM: “Non-Qualified Mortgages”: Borrowers with tainted credit histories or non-traditional means of servicing the loans. Common borrowers may include foreign nationals, business owners, investors, or asset heavy borrowers who have limited current income.

NPL/RPL: “Non-Performing Loans / Reperforming Loans”: These loan pools are backed by borrowers who are either in default or have gotten back on track after being in distress.

CRT: “Credit Risk Transfer”: These deals were created to allow agencies to offload balance sheet risk to investors and share risk of loss.

Key Risks:

-

Interest Rate: As market risk-free rates change, the value of bond coupons change as well. In a rising rate environment, fixed-rate securities will be negatively affected, and conversely, will benefit as rates fall. The effects of these moves would be further escalated based on the duration of the security. Higher duration securities would generally exhibit larger price movements based on the movement of interest rates. Floating rate securities tend to hold steadier during changing interest rate environments as they price at a spread over the risk free rate. Investors in structured credit have the benefit of choosing from both fixed and floating rate securities which allows managers to adjust interest rate exposure based on their view of future rate moves.

-

Credit Risk: Private label mortgages in RMBS include a component tied to borrower defaults. While there are structural elements that can help mitigate losses, managers must ultimately be able to underwrite the probability of borrower default and assess recoveries given default. A manager’s ability to underwrite loan level data is critical to its ability to successfully manage a portfolio of private label RMBS.

-

Credit Spread: Similar to other instruments such as municipal bonds and corporates, structured credit trades at a spread relative to risk-free rates. Theoretically this spread should reflect market sentiment around risk of default or impairment. In times of elevated volatility, these spreads tend to widen, which can affect bond values. Similarly, during times of peace, these spreads can tighten and serve as a tailwind to valuations.

-

Prepayment: Residential loans are typically created to allow borrowers to prepay at any time. Because of this, RMBS bonds tend to be negatively convex. In more simple terms, as rates drop, bond values tend to go up, however, the likelihood of borrower prepayment should increase if it is more economical for a borrower to refinance into a lower interest rate loan. Generally, this can serve as a benefit to investors that own bonds at a discount to par, or an adverse phenomenon to investors that own bonds at a premium to par as the expected coupon stream is shortened by the pool paying down more rapidly. Generally, prepayments can be either a downside or upside, depending on the nature of the security and should be a consideration to keep in mind during the security selection process.

-

Liquidity: The RMBS market trades Over-the-Counter (OTC). This means that human beings actually negotiate trades as they happen rather than machines driving transactions on an exchange. During times of lower volatility, liquidity may be abundant, and the depth of buyers and sellers of securities may be robust. At other times, macro forces may cause liquidity to dry up which would affect a manager’s ability to raise liquidity in an efficient manner.

-

Structural: Losses from the entire loan pool impact the lowest RMBS tranche first and move upward once that class has suffered a full loss. For example, in simple terms, if you own the bottom tranche which is 10% of a deal, then the first 10% of loan losses would cause a full loss of investment. Alternatively, if you own a tranche higher up – with the lower tranches making up 30% of a deal, the first 30% of losses to the pool are not applied to your tranche - you are protected by the tranches below. Interest Only securities are often tied to specific P&I tranches of a deal and are impacted in tandem. These phenomena are known as structural leverage and structural protection.

General Disclosures

This presentation provided by Peak53 Partners, LP (“Peak53”) has been prepared solely for informational purposes and may not be relied on in any manner as legal, tax or investment advice or as an offer to sell or the solicitation of an offer to buy an interest in any fund, including Peak53 Structured Opportunities Fund, LP (the “Fund”), which can only be made by a private placement memorandum (the “Memorandum”) that contains important information about each fund’s risks, fees and expenses. In the case of any inconsistency between the descriptions or terms in this document and the Memorandum, the Memorandum shall control. Peak53 reserves the right to change any terms of the offering at any time. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied.

While all the information prepared in this document is believed to be accurate, Peak53 makes no express warranty as to the completeness or accuracy of such information, nor can it accept any responsibility to update errors appearing in the document. More complete information about Peak53’s products and services is contained in the offering documents for such products and services, which are available on request. This document is strictly confidential and intended exclusively for the use of the person to whom it was delivered by Peak53. This presentation may not be reproduced or redistributed in whole or in part.

Products managed by Peak53 are intended for sophisticated investors and the information in these materials is intended solely for “Qualified Clients” within the meaning of Rule 205-3 under the Investment Advisers Act of 1940, as amended. Any products or service referred to herein may not be suitable for any or all persons. This presentation includes “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, as amended, and the U.S. Securities Exchange Act of 1934, as amended, or the “Exchange Act.” Forward-looking statements are not based on historical information and include, without limitation, statements regarding our future financial condition and results of operations, business strategy and plans and objectives of management for future operations. Forward-looking statements reflect our current views with respect to future events. The words “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “project,” “estimate” and similar expressions identify forward-looking statements. These forward-looking statements are based upon estimates and assumptions made by us or our officers that, although believed to be reasonable, are subject to certain known and unknown risks and uncertainties that could cause actual results to differ materially and adversely as compared to those contemplated or implied by such forward-looking statements.

All forward-looking statements involve risks, assumptions and uncertainties. You should not rely upon forward-looking statements as predictors of future events. The occurrence of the events described, and the achievement of the expected results, depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially from expected results. These risks, assumptions and uncertainties are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. All of the forward-looking statements we have included in this presentation are based on information available to us on the date of this presentation. We undertake no obligation, and specifically decline any obligation, to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation might not occur.

The strategies described or contemplated herein are subject to a variety of risks and there can be no assurance that the investment objectives will be achieved or that the strategies described will be implemented. The strategies described or contemplated herein are not “conservative”, “safe” or “risk-free”. Loss of principal may occur. Economic, market and other conditions could also cause the Fund to alter its investment objectives, guidelines, and restrictions. Any projections, outlooks or assumptions are subject to change and should not be construed to be indicative of actual events which will occur. Please review the Fund’s private placement memorandum for an explanation of other risks.